Case study: Building a culture of transparency at DWF

The latest case study in our series looks at how leading firms manage to translate their responsible business efforts into clear and transparent reporting.

Lamp House’s first annual report shared the stat that only 22% of firms release any kind of holistic responsible business report.

We know from speaking to many firms that there are big gaps between what the firm may be doing internally and what it is communicating outwardly. Part of this is a natural challenge in keeping official channels (like websites, reports) up-to-date, but for some firms it is also a result of deeper issues: lacking a strategy and focus around responsible business, poor understanding of what responsible business means internally and low confidence in talking about the firm’s work in this space.

DWF is one of the exceptions. It is the leading firm in the Governance category in the first Lamp House report.

We spoke to Dan Noakes, Head of ESG, Operations and BD at DWF, to understand what the firm has done that allows it to be so transparent, clear and specific in its own external reporting.

Dan Noakes, Head of ESG, Operations and BD

Dan’s role at DWF has two main focuses; the first is centred around what the firm is doing internally on ESG and embedding this across everything the firm does. Dan has been instrumental in setting the strategy for the firm and establishing metrics and KPIs. The second aspect of his role is developing the firm’s ESG client proposition and introducing this practice to a wider range of clients.

Dan joined DWF in 2020, and he has been in his current role since September 2021. Dan previously worked for Charities Aid Foundation (CAF) for 12 years. His role at CAF also focused on ESG, where he designed strategies for high net worth individuals, families and corporates with a particular focus on; ESG investing, impact investing and CSR/philanthropy.

Overview of the report

Following the launch of its new strategy in December 2021, DWF is now on its second annual ESG Impact Report. The report is written and structured with different audiences in mind: the first section is focused on governance, which is intended to appeal to investors (DWF was a listed company at the time of the report’s publication).

The middle section is intended to appeal to potential talent, and showcase DWF as a place to work. It features case studies on what the firm is doing to support the environment (such as its carbon literacy training) and its commitments to diversity and inclusion (for example, its new menopause support policy).

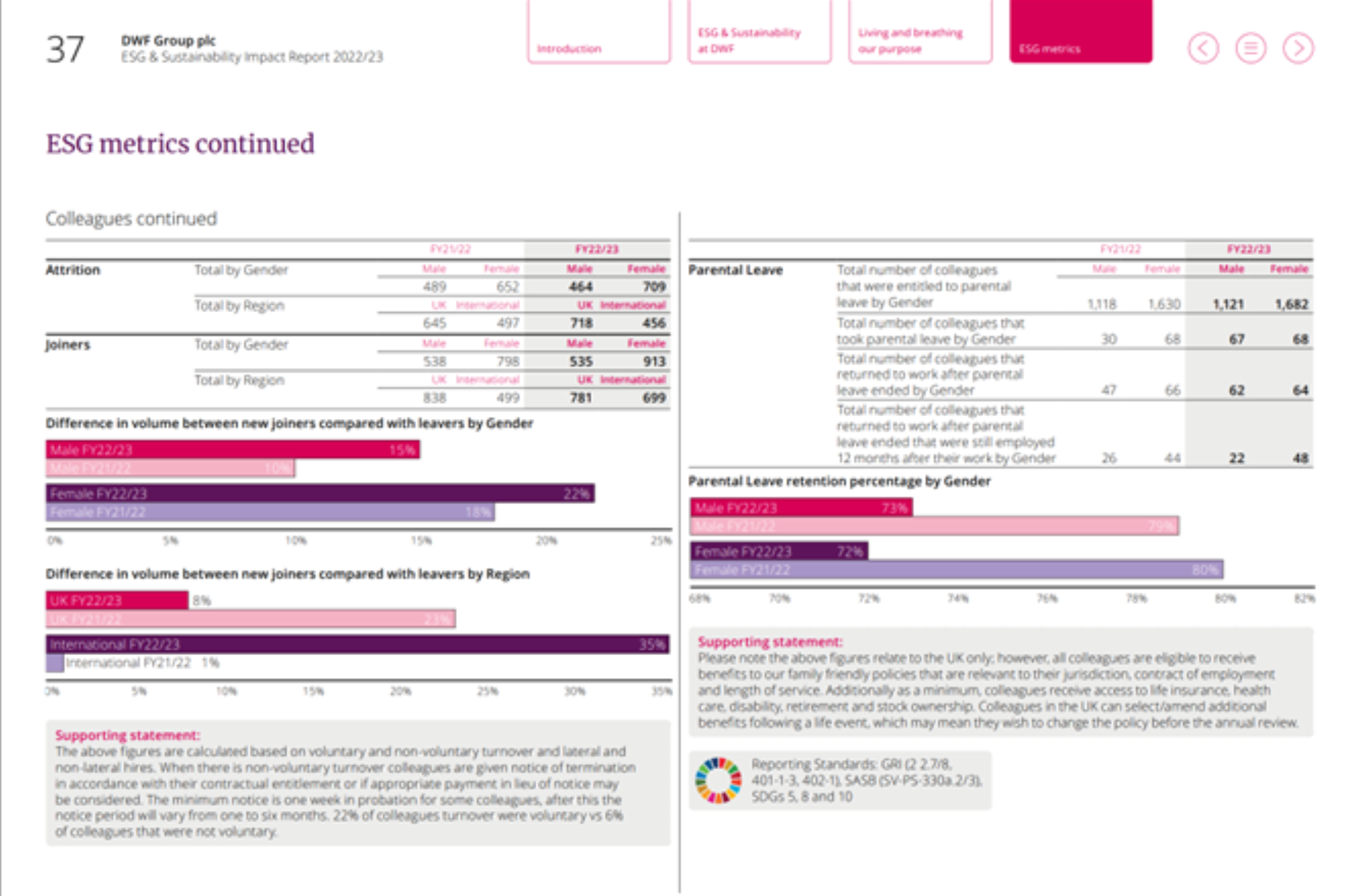

The final section speaks to clients, with detailed year-on-year metrics on the firm’s carbon emissions, energy consumption, diversity composition, attrition and parental leave retention.

How does DWF manage to be so transparent:

- Having an overall strategy: By establishing key strategic pillars to guide the firm’s ESG strategy, it has been easier to understand what reporting can and should look like to stay aligned with these pillars. One of the firm’s key pillars is around building trust and transparency; this really helped Dan to push the business into being more transparent than it had ever been before, with the report able to be clear about where the firm needs to improve and the steps it is taking to do this.

- Aligning to wider frameworks: The Global Reporting Initiative (GRI), Task Force on Climate-Related Financial Disclosures (TCFD), CDP, EcoVadis and the UN Sustainable Development Goals have also provided focus on what the firm should include in its reporting.

- Culturally recognising transparency as being important: As the firm was listed previously, there was also a duty to shareholders to be as transparent as possible. Dan feels this helped shift the culture internally, so that people realised you need to talk and communicate about what you are doing and the progress you are making in order to move forward in this space. Dan is also keen that by sharing case studies and best practices, there is more opportunity to collaborate with clients, peers and industry associations to keep moving forward.

Highlights from the programme:

In Dan’s view, the level of transparency the firm achieved is one of the main successes of the report – especially given this was something new for the business.

“We just want to show that we know what we are talking about in this space, but also being completely open about our business”

The report itself has been a useful tool in raising awareness internally of what the firm is doing to progress. It is a central point of information, with content that can be easily reused in bids or tenders.

The establishment of the firm’s ESG practice, and a dedicated partner for ESG & Sustainability, has also helped with raising awareness. DWF's imperative is to ‘communicate, educate and engage’, and that has meant working much more closely with different teams to share what the firm is doing and also to help teams realise opportunities for supporting clients in this space.

Earlier this year, the firm developed a series of training sessions for their global senior leadership team to educate them more about ESG, what it means for them, the business and how they can start conversations with clients about it. Dan feels one of the successes of all this work combined is people starting to realise the commercial opportunity of ESG, as well as the risks that need to be managed to secure the firm’s longer-term success. This has somewhat helped overcome people seeing ESG as separate strands – CSR, D&I, Sustainability – and now being able to bring it all together.

Future direction

Dan already has a list of ideas of what data he would like to show in the next report – some of this is about linking different data together (for example, hours of training by gender, age and location). He has been working with data teams since the report’s release to enhance the current systems for recording, creating and analysing data.

Even though the firm is no longer listed, Dan is not intending on scaling back the firm’s reporting: “We are at this position where we have done it, why would we now go back on that? We are advanced in our reporting and disclosure compared with some of our peers so let's continue to lead by example.”

Dan expects the report will continue to evolve over time, and there are certain issues he'd like to address in more detail – like biodiversity and nature. He also thinks it’s important to report year-on-year progress, and restate the firm’s targets in every reporting cycle.

DWF is also undergoing its second materiality assessment, having committed to refresh this exercise every two years. This may change the content of future reporting as the firm moves to understanding more about financial impacts within the materiality assessment, also known as 'double materiality'.

Challenges

There was some initial reluctance to share certain data for the first time - for example, staff turnover, new joiners, and details of parental leave. Ultimately, the firm decided to publish this information in line with its commitments to transparency and trust.

Being a global firm, there are also limits on what can be reported from a diversity perspective. While the firm cannot ask for some data in particular locations, Dan said it is still important to be mindful that there is diverse representation in those countries and jurisdictions.

Advice

We asked Dan what advice he would give to other law firms looking to create more transparency in their responsible business communications:

- Getting familiar with frameworks, like TCFD

“It doesn’t necessarily have to be about disclosure at this stage but just familiarising yourself with the 11 recommendations and starting to think about how you can build it into your day-to-day operations is a good start. It will likely become mandatory for more companies in the future, so getting ahead of it now means you have already begun the hard work.”

- Focus your strategy (with stakeholder input)

“Focus on a few key areas that are relevant to futureproofing your business and the impact you have on the environment and society. Climate action and D&I, I would have thought probably was on every law firms’ radar anyway. Materiality assessments can help; it doesn’t need to be anything grand, even if you just engage with a handful of key stakeholders to gain their insights will really help."

- Be open to collaborating with peers

“Don’t try and do it alone, speak with your colleagues and your peers, we're all in it together. Ultimately, we are here to try and achieve the same thing.”